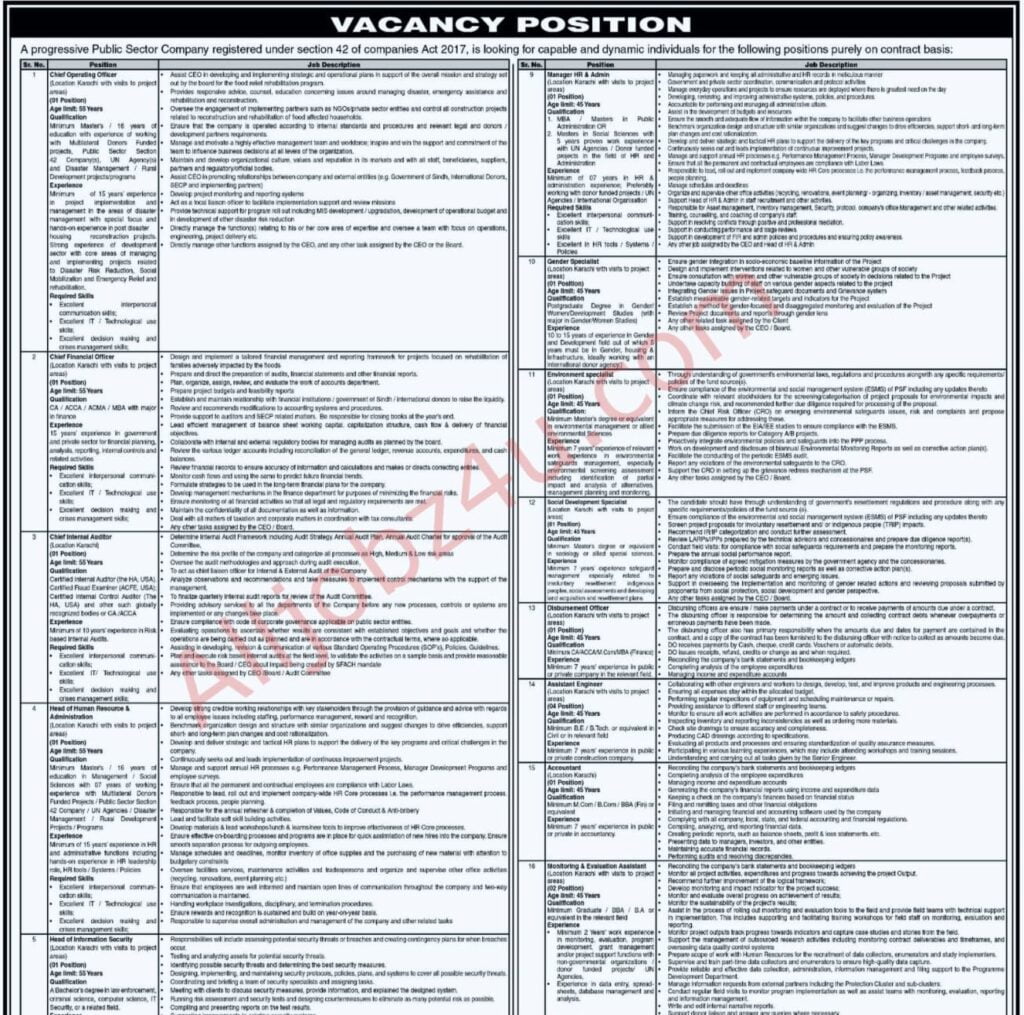

This post is about an Accountant Jobs In Karachi, and according to section 42 of 2017 Karachi is where this place is located. The company is registered and Daily Jang news is always graded in publishing and notifying about the latest events or ongoing news. Education level must be graduated under a finance or business degree and should have studied B.com, M.com, BA, CA, ACCA, ACMA, and further masters and a higher level of degree is required for the offer mentioned below.

Who Is An Accountant?

An accountant aids businesses in making crucial financial choices by collecting, tracking, and updating the company’s accounts. They are in charge of financial audits, bank statement reconciliation, and ensuring the correctness of financial records throughout the year. The right accountant will ensure that your accounts are balanced, your tax requirements are met, and you can make confident business decisions based on accurate financial data. If you need to recruit an accountant, the first step is to understand what an accountant does daily at your company and then explain your needs in a compelling, tailored job description.

This sample accountant job description might help you create an application that will attract highly qualified candidates. Please feel free to modify this template to match your individual needs. You can also look through some of the current accounting jobs on Monster to get ideas for writing the best description.

In this section of your accountant job description, you should discuss your company’s working hours and benefits. You should educate prospective accountants on work-from-home and support staff alternatives, and you can also use this time to highlight the benefits that set your business different, such as stock and ownership possibilities, paid parental leave, and corporate travel accounts. Finally, as you examine your accountant’s job description and compensation ranges to give candidates, having a clear understanding of the median income and job outlook for accountants may be beneficial.

Accountant Responsibilities And Duties:

- An accountant researches and analyses accounting data to provide financial information to management; prepares reports.

- Compiles and analyses account information to create asset, liability, and capital account entries.

- The accountant enters account information to record financial activities.

- An accountant analyzes accounting choices to make financial recommendations.

- Accountant collects information and prepares a balance sheet, profit and loss statement, and other reports to summarize the current financial situation.

- An accountant does audit documentation substantiating financial transactions.

- An accountant is responsible for maintaining accounting controls by developing and recommending rules and procedures.

- An accountant coordinates activities and answers inquiries for accounting clerical personnel.

- The accountant collects and analyses account information to reconcile financial inconsistencies.

- Accountant complete database backups to protect financial information.

- An accountant follows internal controls to maintain financial security.

- The accountant verifies papers and requests disbursements to prepare payments.

- Accountant researches and interprets accounting rules and regulations to provide answers to accounting procedure questions.

- Complies with federal, state, and local financial legal requirements by researching the current and future legislation, ensuring compliance, and advising management on appropriate measures.

- He develops customized financial reports by collecting, evaluating, and summarizing account information and trends.

- By keeping financial information discreet, he maintains client confidence and safeguards operations.

- Accounts payable and receivable must be reconciled by an accountant every day, week, or month.

- He does maintain timely bank payments

- Prepares tax returns and computes taxes

- An accountant manages balance sheets and profit/loss statements.

- An accountant provides information about the company’s financial health and liquidity.

- Financial transactions and records must be audited.

- Accountant maintains financial data confidentiality and backup databases as needed.

- An accountant observes financial policies and regulations.

Skills Required For An Accountant:

- Accounting work experience is a must.

- Outstanding understanding of accounting standards and processes, including Generally Accepted Accounting Principles (GAAP)

- Experience with accounting tools such as FreshBooks and QuickBooks

- Knowledge of general ledger functions

- An accountant pays excellent attention to detail and has analytical skills.

- BSc in Accounting, Finance, or a related field for an accountant.

Additional certification of CA, CP, ACCA, and CMA is an advantage for an accountant.

- Accounting/finance experience of at least 5-10 years is required.

- Knowledge of financial reporting requirements.

- Working knowledge of several legal entities operating under various legal covers.

- Corporate Finance Accounting

- Reporting Capabilities

- Detail-Oriented Reporting Deadline-Oriented Research Results

- SFAS Regulations

- Confidentiality

- Data Entry Management Time Management General Math Skills required.

Experience Needed:

A good candidate as an accountant should be familiar with accounting and financial software and be up to date on current trends. A good accountant pays attention to detail, which allows them to examine financial statements, identify flaws, and make required fixes. They are well-versed in accounting software programs and are continuously attempting to broaden their knowledge of various software in order to accomplish their job effectively. Working with spreadsheets at an expert level is required. For preparing and composing reports for record-keeping and presentations, experience with word-processing software is required.

Accountants should also have experience managing a company’s finances and creating a budget based on income and spending records. Experience conducting internal and external audits is a plus. It is necessary to have prior knowledge of general ledger functions.

To Whom Is The Accountant Report To:

Accountants usually report to either an Accounting Manager or a Controller. An Accounting Manager is a skilled accountant in control of the accounting department and its employees. They create expectations and transmit upper-management concepts. A Controller may function at a higher level than an Accounting Manager, controlling a company’s overall financial systems and collaborating closely with the finance or accounting departments.

HOW TO APPLY:

You can check this website ( https://governmentjob.pk/ ) and addresses for further guidelines and page if you want to visit for this Accountant Jobs In Karachi

Candidates interested in working in the following districts should email their CVs to hr.recruitment.sn@gmail.com / hr.recruitment.2k22@gmail.com within 15 days.

Advertisement:

JOB TITLE: ACCOUNTANT

JOB POSTED ON: 5TH NOVEMBER, 2022.

LAST DATE TO APPLY: 19TH NOVEMBER 2022

LOCATION: KARACHI

COMPANY: PUBLIC SECTOR ORGANIZATION

JOB TYPE: PRIVATE JOBS

EDUCATION: GRADUATION

VACANCY: 200+

ADDRESS: CHIEF EXECUTIVE OFFICER, PROGRESSIVE PUBLIC SECTOR ORGANIZATION KARACHI

Thanks for reading, do share this with friends and family. Also, follow for new updates and Keep visiting AllJobz4u for more jobs-related material, thanks

Give me job drivir

Sir I have LTV licence